hotel tax calculator bc

Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax. 2021 Income Tax Calculator Canada.

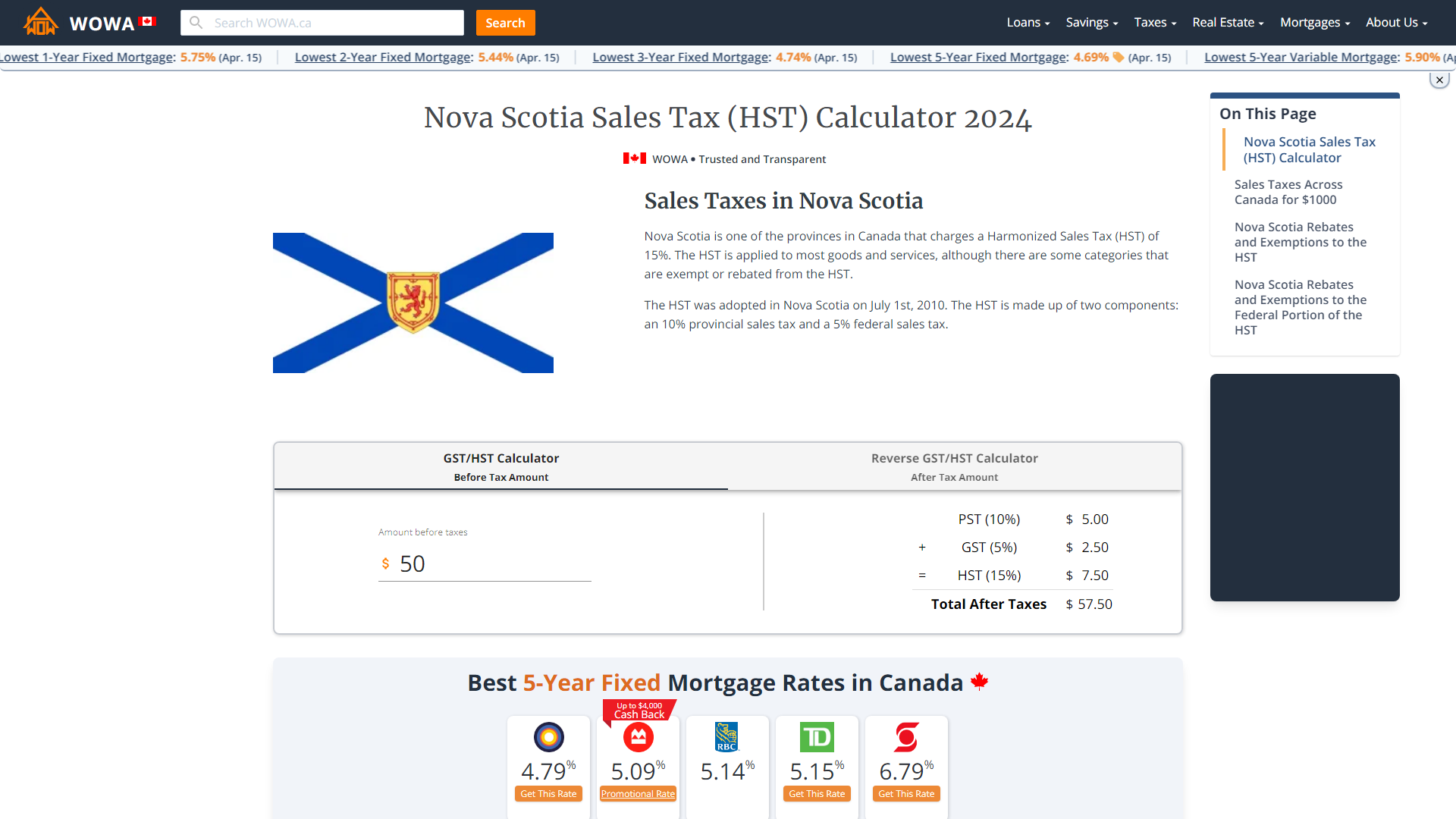

Nova Scotia Sales Tax Hst Calculator 2022 Wowa Ca

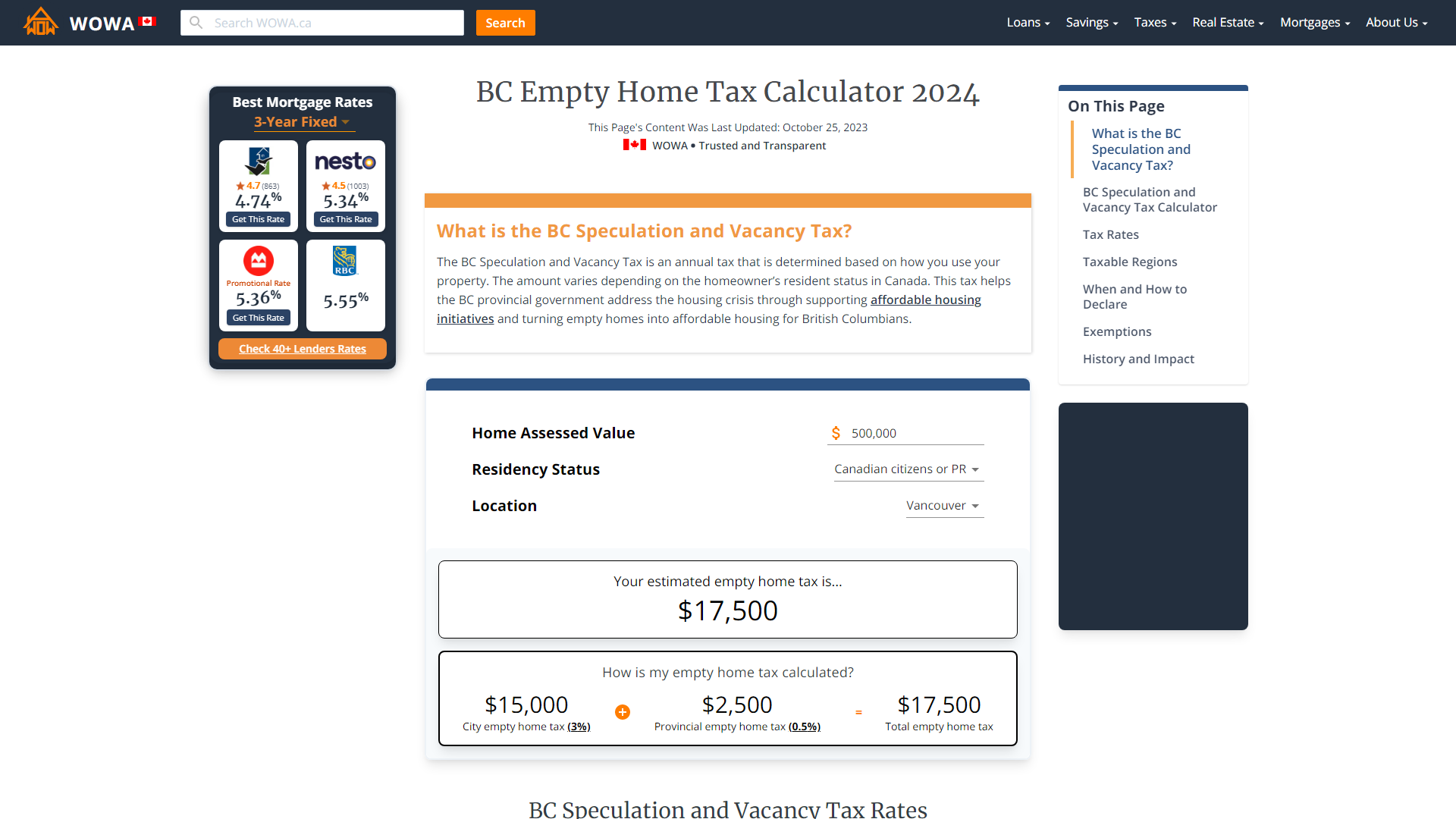

The City of Vancouver recently announced that the Vancouver Empty Home Tax will increase to 3 in 2021 compared to 125 in 2020.

. Automate state and local taxes on rental properites so you can focus on guest experience. Some communities such as Downtown Victoria have an. Current GST and PST rate for British-Columbia in 2021.

Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. BC Revenues from Sales Taxes. Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it.

The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada. As of April 1 2018 the governement of British Coloumbia introduced revised tax rates for luxury passenger vehicles. Automate state and local taxes on rental properites so you can focus on guest experience.

In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations with four or more. Usually the vendor collects the sales tax from the consumer as the consumer makes a. Calculate the total income taxes of the British Columbia residents for 2021.

This rate affected vehicles valued at 125000 or more. The rate you will charge depends on different factors see. It is generally progressive because it is paid by businesses and higher.

A hotel and accommodation tax or levy is a specific fee on hotel or motel charges. Canadian Sales Tax Calculator GST HST PST This free calculator is handy for determining sales taxes in Canada. Use our Income tax calculator to quickly.

For example if your hotel is located in Vancouver which is subject to a 2 MRDT and a 15 destination marketing fee and you provide a room in your hotel for 200 per night your guest. Revenues from sales taxes such as the PST are expected to total 7586 billion or 225 of all. 2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts.

Provincial federal and harmonized taxes are automatically calculated. GSTHST provincial rates table. The period reference is from january 1st 2021 to.

GST 5 PST 7 on most goods and services. 1 This regulation may be cited as the Hotel Room Tax Regulation. So if the room costs 169 before tax at a rate of 0055 your hotel.

Hotel and accommodation taxes. Including the net tax income after tax and the percentage of tax. The following table provides the GST and HST provincial rates since July 1 2010.

8 rows Income Tax Calculator British Columbia 2021. No hotel tax or levy YUKON No hotel tax or levy BEYOND CANADA NEW YORK STATE New York State legislation plus munic-ipal andor county authorizations to collect taxes on their behalf. This is income tax calculator for British Columbia province residents for year 2012-2021.

Sales taxes make up a significant portion of BCs budget. Taxable and Exempt Accommodation Definitions For the purpose of PST and. This new rate will apply to all applicable properties in.

Current BC personal tax rates in British Columbia and federal tax rates are listed below and check. Now multiply that decimal by the pretax cost of the room to find out how much the hotel tax will add to your bill. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

2021 free Canada income tax calculator to quickly estimate your provincial taxes. Get better visibility to your tax bracket marginal tax rate. You can calculate your Annual take home pay based of your Annual gross income and the tax.

21 In this regulation unless the context otherwise requires section 1 of the Act shall apply. The British Columbia Annual Tax Calculator is updated for the 202021 tax year. A tax rate increase will only take effect after an application has been approved by regulation.

Provincial Sales Tax PST In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed.

British Columbia Empty Home Tax Calculator 2022 Wowa Ca

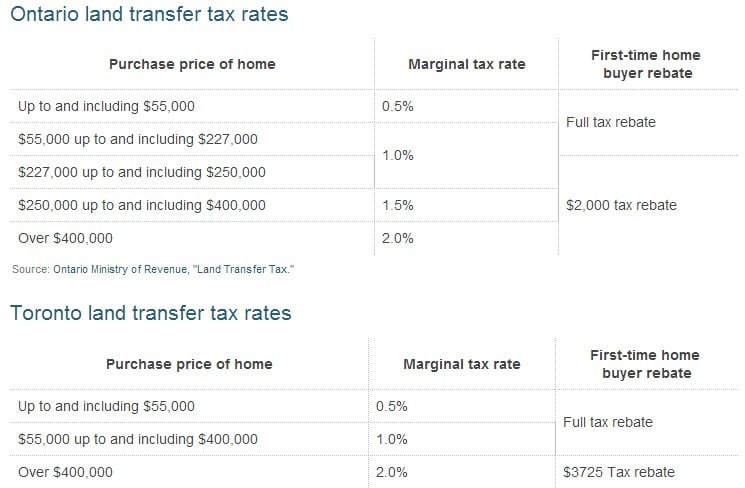

Land Transfer Tax In Toronto Ratehub Ca

Mathematics Day Math Is Everywhere Is He Interested Interest Calculator

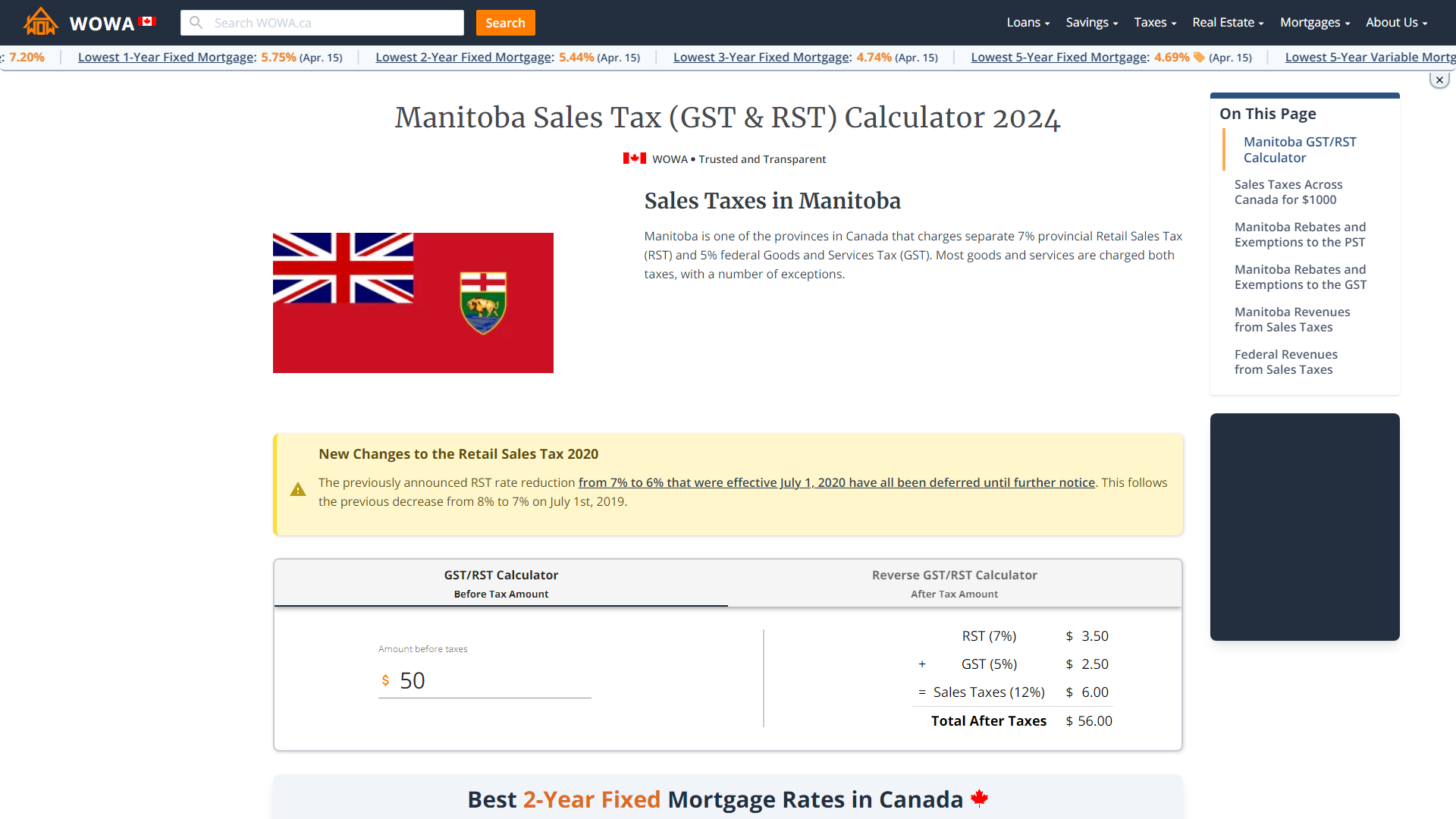

Manitoba Gst Calculator Gstcalculator Ca

Calculate Import Duties Taxes To Canada Easyship

Land Transfer Tax In Toronto Ratehub Ca

Manitoba Sales Tax Gst Rst Calculator 2022 Wowa Ca

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

How To Charge Your Customers The Correct Sales Tax Rates

Income Tax Calculator App Concept Calculator App Tax App Discount Calculator

New Brunswick Sales Tax Hst Calculator 2022 Wowa Ca

Calculator Application For A Private Mortgage Insurance Startup By Extej Design Agency On Dribbble Private Mortgage Insurance Calculator Design Start Up

The Independent Contractor Tax Rate Breaking It Down Benzinga

The College Board On Twitter Business Major College Board Teaching Management

Chairmans Annual Report Template 3 Templates Example Templates Example In 2022 Report Template Annual Report Templates